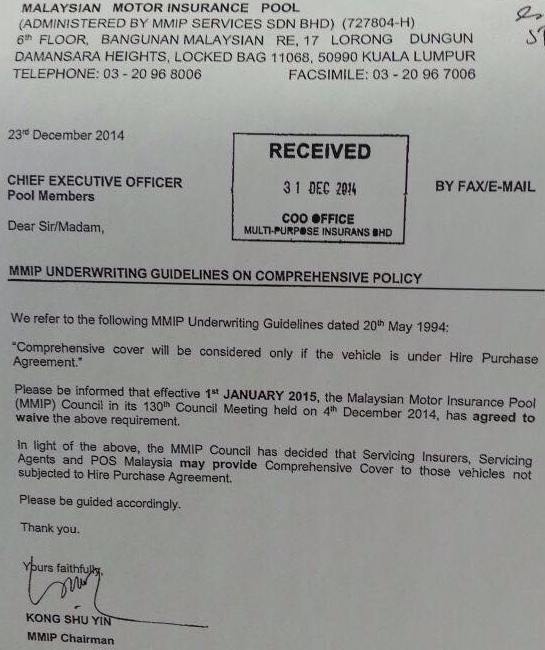

[UPDATE] AF has received news that the Malaysian Motor Insurance Pool has waived the 1994 guideline concerning Comprehensive Insurance coverage for older vehicles, which reads “Comprehensive cover will be considered only if the vehicle is under Hire Purchase Agreement”. Following a new requirement as of 1 January 2015, older cars that are fully paid-up are now also entitled to comprehensive coverage. Got a nice old car in your home? Perhaps its now time to update to comprehensive coverage.

Welcome to the first installment of AF’s Automotive Tips & Tricks! In this new segment we’ll delve into the other aspects of car ownership, after all the glitz and glamour of a car launch is over, and after the lights have faded and the ticker-tape swept away, what happens really once you’ve bought the car? As everyone knows, car ownership is a taxing experience, in every sense of the word, and thus we’ll try as best as possible in this new segment to make that experience as pleasurable and hassle-free for you as possible. It won’t be easy, but if you pay attention, we might just be able to save you a few bucks! Let’s start with something ‘peripheral’ that every car out there on the road, regardless of make, model and age, needs to have: Car Insurance. Buckle up, let’s get started! – CW.

Car insurance is the sort of thing that people pay, because the have to, and usually forget about, until they need it, kinda like the spare tyre in your boot. Got you thinking about that spare now huh? And it’s only when it comes to claims, they start to panic, as they don’t know the actual procedure to handle the whole situation. To remedy this, we will be posting guides about car insurance in Malaysia. For starters, car insurance is compulsory under Section 90 (1) of the Road Traffic Ordinance 1987.

In Malaysia, there are 3 different types of car insurance, namely third party, third party fire & theft and comprehensive. Let’s break it down:

1) 3rd Party – For those on a tight budget, their only choice is third party coverage. Simply put, third party coverage only covers the third party (others), not the first party (you). The first party is not allowed to claim his own insurance should something happen, be it damage or theft. It is the cheapest insurance option to legally get your car on the road, in Malaysia. Despite its cheaper price, it may not be so easy to get third party insurance coverage, as accident rates are increasing in Malaysia. Due to that, insurance companies would rather push for comprehensive coverage instead of third party coverage. Also, if your car is still under financing, third party insurance coverage is not possible, and thus it’s mainly for older cars, with no outstanding loans. As some put it, third party is the insurance YOU buy for other people.

2) 3rd Party F&T – Moving one level up, there’s the third party fire and theft. Like its name implies, it is also similar to the third party coverage, but with added fire and theft coverage. If the owner’s car gets stolen, or gets damaged in a fire, they can claim, but only for that. The rest of the terms are the same like the third party coverage. Windscreen is also not covered under 3rd party coverage.

3) Comprehensive – Finally then there’s comprehensive coverage. Comprehensive coverage covers third party bodily injury and death, third party property loss or damage and loss or damage to your own vehicle due to accidental fire, theft, or accident. However, vehicles older than 15 years old are only allowed for third party coverage, not comprehensive coverage.

For natural disasters or acts of God like floods, tsunamis, trees falling down, comprehensive coverage do not cover such damages. Some insurance companies may allow you to add on optional benefits to cover you from such disasters, but only for comprehensive coverage.

For the next post, we will be looking into what to do in an event of an accident (touch wood). Got something to say? Leave us a comment below and we will get back to you.

Other posts by AF Newsdesk