Based on the inaugural J.D. Power 2017 Malaysia Auto Consumer Finance Study, nearly half (43%) of Malaysia new-car buyers do not fully understand the terms of their auto finance agreement.

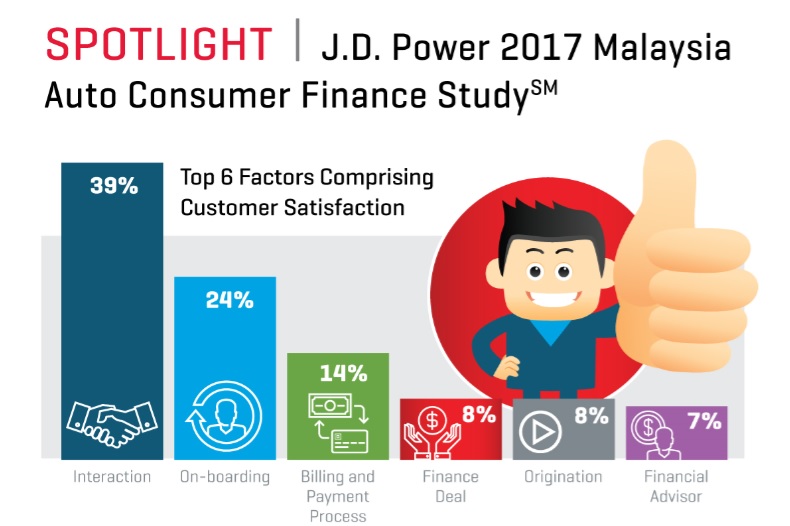

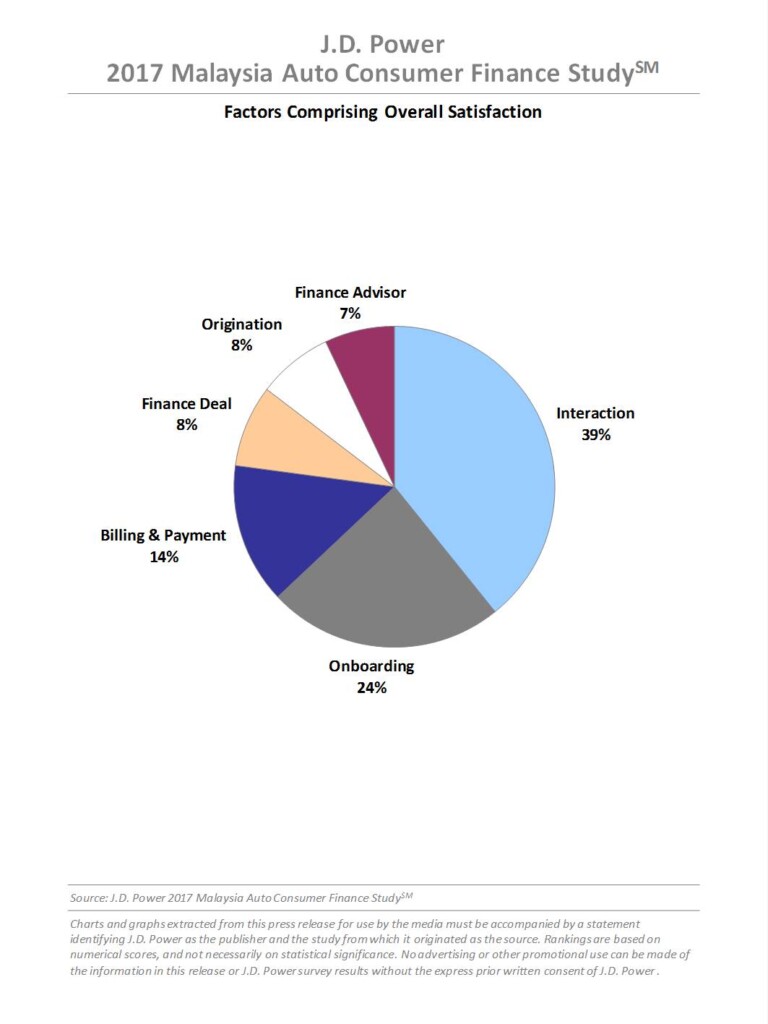

The study measures customer satisfaction with their automotive finance provider by examining 6 key factors (in order of importance): interaction; onboarding; billing & payment; finance deal; origination; and finance advisor.

“With less than half of auto finance customers claiming the finance arrangement actually met their requirements, there is a clear need for the industry to become more customer-centric,” said Anthony Chiam, practice leader of service industries at J.D. Power. “Auto finance is a long-term commitment and it’s crucial that dealership salespeople spend sufficient time to clearly explain the services, terms and fees related to each customer.”

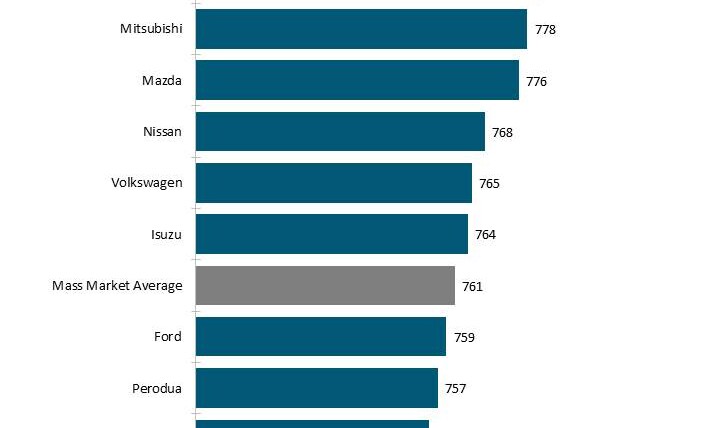

Satisfaction levels during the purchasing process vary greatly between customers whose finance application was handled by a finance advisor vs. a car salesperson. On a 1,000-point scale, a finance advisor has an average score of 777, compared with a salesperson’s average score of 735.

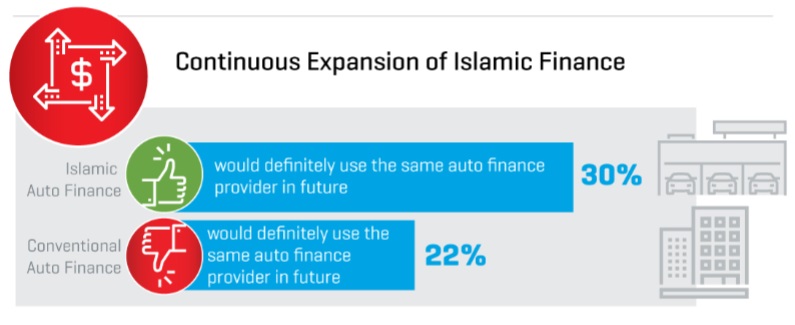

Among customers who selected an Islamic auto finance product, more than 30% say they “definitely would” use the same finance provider for their next purchase, compared with 22% among customers who purchased a conventional auto finance product.

“Malaysia’s Islamic finance industry has been growing rapidly over the past 30 years,” Chiam said. “Higher customer satisfaction levels from within Islamic auto financing underscore the industry’s impressive and continuous expansion.”

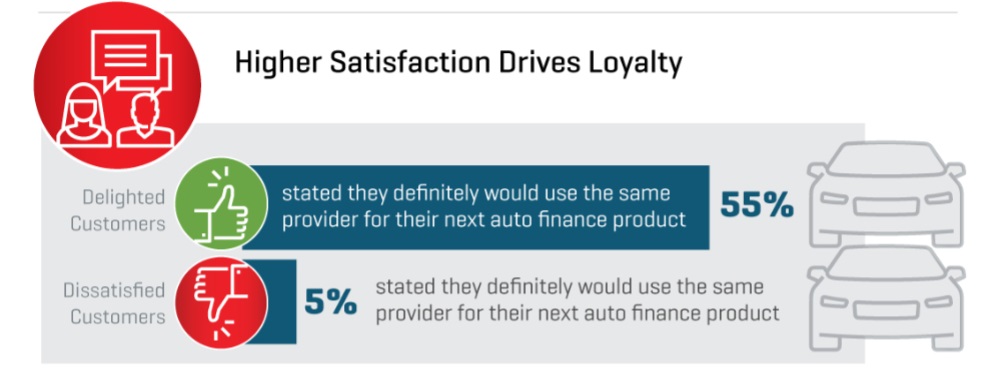

J.D Power also gathered additional findings of the study and found that 55% of customers who were delighted with their experience (overall satisfaction scores of 852 or higher) say they “definitely would” use the same provider for their next auto finance product, compared with only 5% of those who were dissatisfied (650 or below).

The overall satisfaction of people purchasing Islamic auto finance products are higher than among those buying conventional auto finance products (758 vs. 744, respectively).

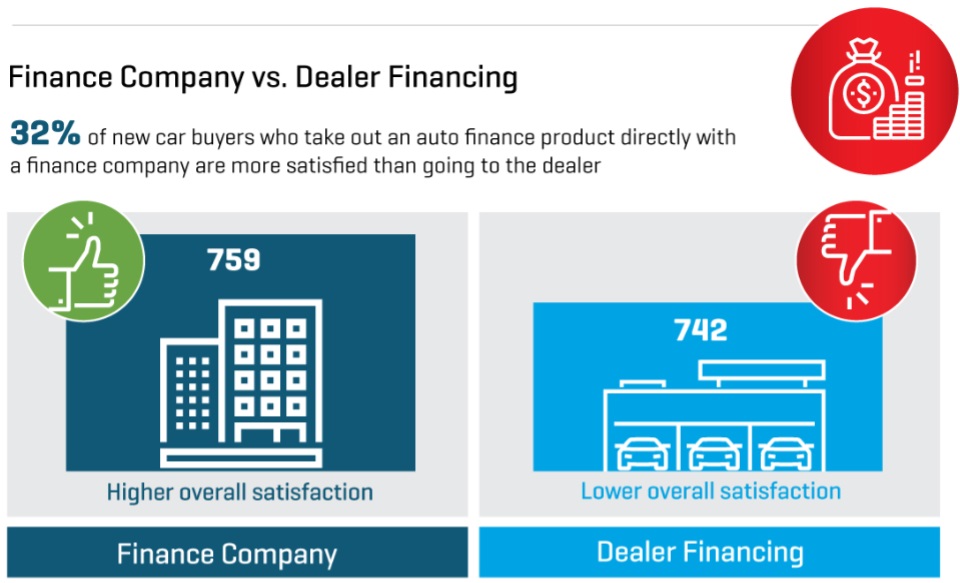

The study also finds that nearly one-third (32%) of new-car buyers who purchase a finance product directly from a finance company are more satisfied than those going through a dealer to arrange financing (759 vs. 742, respectively).

JD Power conducted the 2017 Malaysia Auto Consumer Finance Study based on responses from 2,683 new-car buyers who financed a vehicle in the past 12 months. The study was fielded in January-March 2017.

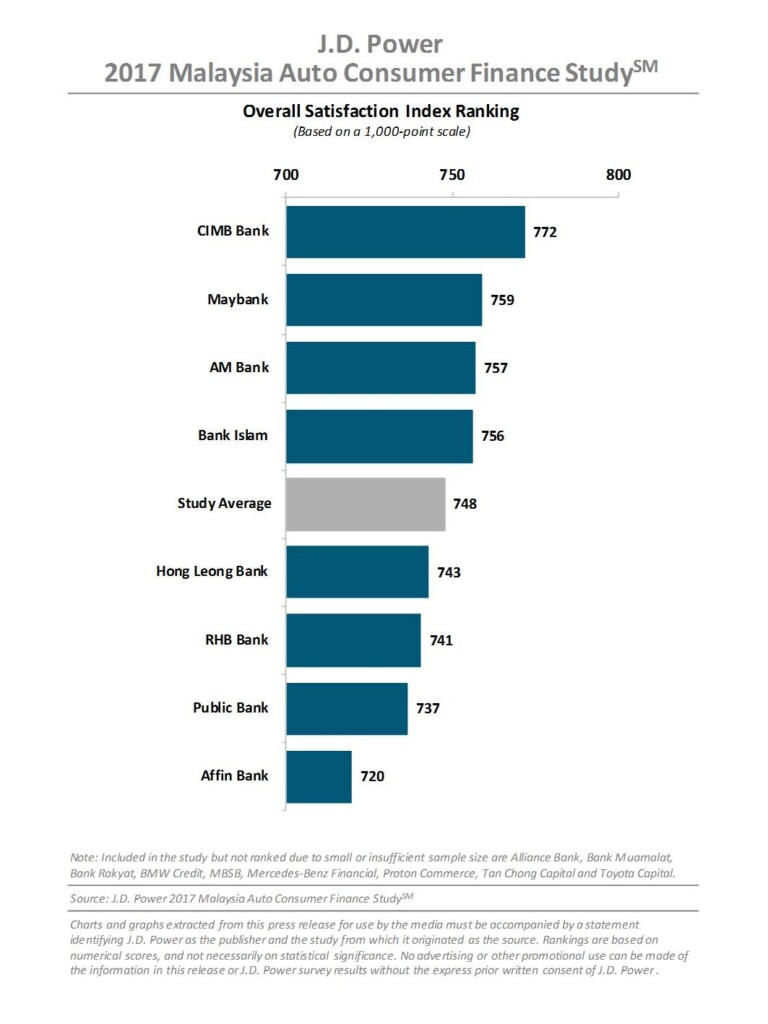

Based on the rankings below, CIMB Bank ranks highest with an overall satisfaction score of 772. CIMB Bank performs highest across all 6 factors.

Maybank ranks second (759), performing particularly well in the onboarding and billing & payment factors. AM Bank ranks third (757), performing well in the finance advisor factor.

Source: JD Power

Other posts by AF Newsdesk